A lot of things come to mind when we hear the word “insurance”. Right now, several properties can be put under insurance for protection in case of financial loss. It can be buildings, lands, health, life and other matters. The insurance carrier offers packages to the buyer on insurance payments. It is paid on an installment basis for a certain period of time. This is the common system of most insurance companies. You may also see proposal samples.

alliednational.biz

Before any insurance agreements come to life, it is usually written down in a proposal. The proposal can help in convincing the client to get the insurance package that you offer. You have to be accurate with the facts that you write since you are attempting to get the client’s trust. Insurance is something people can rely on in case something bad happens. You may also see Free Proposal Templates

In writing an insurance proposal, take note of these steps.

You can’t write a proposal without getting the necessary information. Go to your company’s products and services and take some time to study them carefully. From there, you can determine what kind of business plan to offer. Further information includes the company census and the percentage of the people that can be covered by the insurance. You may also see Proposal Templates in PDF.

Doing a research on your potential clients helps you understand their needs. You can put yourself in their shoes and know what their concerns are. With that, it helps you draft a proposal that suits their needs. You can already come up with ways on how to respond to their concerns.

Conclude your proposal by convincing the client that you are the best choice for their prospective purchase of insurance. Some aspects that you could include are the company’s history, the clients you have served, awards you won and testimonials from other clients. This will boost your credibility and the insurance company’s reputation. The conclusion should also include a call to action. Put in there what your client wants to do next.

To add more credibility, put in the company’s logo as proof of your employment. Some people are skeptical when it comes to insurance for fear of being scammed.

Proofreading has always been a big part of any writing process. You can do it on your own. If you don’t have enough time, you can let other people do it for you. As a reader yourself, you would not want to read a proposal with several grammar mistakes, right?

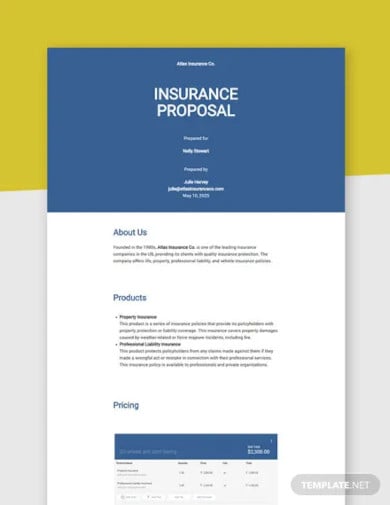

Writing insurance proposals is kind of tricky. You just have to be accurate in what you are writing on and know the business well. To guide you in writing, here are some proposal templates that you can use.

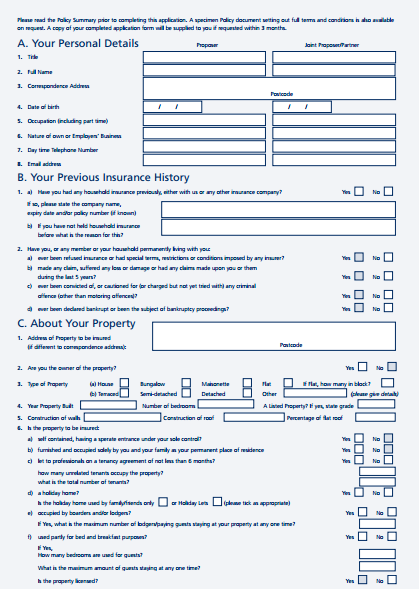

towergateunderwriting.co.uk

With the growing number of insurances that are coming out, it’s hard to think which ones should be availed first. Every insurance of any kind is important as they protect us from the financial loss brought about by unforeseen circumstances. But sometimes, we have to choose those that are more needed than those that we can live without. We have rounded up four kinds of insurances people really need. You may also see proposal templates

As the saying goes, health is wealth. Our good body is what we use to work and live our lives the way we want it. Accidents and illnesses are unforeseen. Depending on the gravity, it may do so much harm in our body or leave us paralyzed for the rest of our lives. Health insurance should be the top priority. If we are not ensured in the event of these two, we would end up indebted in hospitals. By signing up for health insurance, you can rest assured that the cost we pay in hospitals would be lesser compared to its original cost. Health care costs a lot these days.

Properties such as houses and lands should be protected. For houses, in case of fire, agreeing on an insurance is a way of ensuring that the damages will be replaced. A mortgage payment serves as some kind of an insurance when you borrow money from the bank through a loan. Banks will also require an asset to be insured in this case.

Death is an unexpected circumstance. No one knows when it will befall on a person. While you are alive, sign up for a life insurance. Make your loved ones feel that they are not left alone with nothing when you leave this world. List your family as their beneficiaries of your life insurance if you have children. This can help pay debts, children’s education and meet other financial needs after you pass away. For singles, life insurance can cover the costs of burial and other money matters.

A car is what you need to avoid the hassle of commuting in public transportation every day. Auto insurances assure you that your car gets replaced in case of damage caused by accidents. Cars are really expensive these days and buying another one is costly, unless you have a big savings account.

Life is always pretty unexpected. The things we have now can be taken away from us. Insurances help in making up for the expected loss. There’s no other time in getting them than now. Explore additional insurance proposal templates on our website, template.net, to find a variety of options that suit your needs.